Cases & News

Bridging Pillar Two Reporting and Compliance

Multinational groups must consider both Pillar Two financial reporting and local compliance for member jurisdictions. Differences lie with respect to calculations and process implications for the tax department.

Centralized tax processes at Versuni with Longview

Headquartered in Amsterdam, multinational home appliance company Versuni is a leading global designer, manufacturer and seller of domestic appliances with a diversified portfolio of products. We spoke with Kanshi Ram, Tax Accounting and Reporting Lead, to hear how Versuni’s tax department has leveraged Longview Tax to transition to a centralized provisioning process.

Webinar: Is Your Tax Strategy Pillar Two - Ready?

Pillar Two reporting requirements have arrived, effective for the 2024 financial year. Are you prepared to ensure your data integrations, calculations, and workflows run smoothly? Check out our joint webinar with Longview Tax for practical insights on how to improve your Pillar Two strategy.

Three key areas essential for a successful tax automation strategy

In this article, we explore three key areas—processes, data, and knowledge—that are essential for a successful tax automation strategy. Learn how to take small, manageable steps towards automation and transform your tax function into a business enabler.

Orbitax and Taxvibes partnership

By partnering with Orbitax, Taxvibes underscores its commitment to supporting tax functions to streamline and automate their direct tax processes.

Vena and Taxvibes partnership

Taxvibes, a leading direct tax automation provider, enters a strategic partnership with Vena Solutions, the only Complete Planning Platform natively integrated with Microsoft 365. This collaboration will allow us to offer Vena’s deep FP&A capabilities, AI-powered insights and robust data governance into the tax market.

A Success Story at Almatis

For this article, we had the pleasure of interviewing Evelien de Kruijff, Global Tax Manager, at Almatis. Evelien plays a pivotal role in navigating the complex world of taxation. For the past eight years, she has been the sole guardian of Almatis’ tax affairs, overseeing everything from transfer pricing to tax positions across the globe. With Almatis operating internationally across various time zones, Evelien’s role is as diverse as it is demanding.

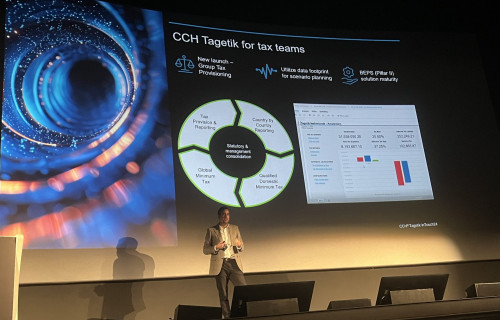

Launch of the CCH® Tagetik Tax Provision & Reporting solution

Following the successful launch and implementation of the Global Minimum Tax (Pillar Two) solution last year CCH Tagetik invested in the development of the Tax Provision & Reporting solution. Want to know more? Read on!

Webinar: How to optimize your Pillar Two framework in OneStream?

We have designed a Pillar Two solution that will help you with the full end-to-end process. In this webinar we will show you how to optimize your framework with this solution!

Taxvibes recognized as a direct tax automation partner by OneStream

OneStream Software and Taxvibes announce their partnership to include direct tax automation to help organizations conquer complexity and drive finance transformation across EMEA.