Cases & News

Webinar: Excel-Based Integrated Tax Automation with Vena

Watch our short webinar to discover how Vena can help you streamline your direct tax processes. See how automation enhances workflows, ensures real-time data accuracy, and simplifies compliance. Covering everything from tax provisioning to Pillar Two reporting.

Bridging Pillar Two Reporting and Compliance

Multinational groups must consider both Pillar Two financial reporting and local compliance for member jurisdictions. Differences lie with respect to calculations and process implications for the tax department.

Webinar: Is Your Tax Strategy Pillar Two - Ready?

Pillar Two reporting requirements have arrived, effective for the 2024 financial year. Are you prepared to ensure your data integrations, calculations, and workflows run smoothly? Check out our joint webinar with Longview Tax for practical insights on how to improve your Pillar Two strategy.

Three key areas essential for a successful tax automation strategy

In this article, we explore three key areas—processes, data, and knowledge—that are essential for a successful tax automation strategy. Learn how to take small, manageable steps towards automation and transform your tax function into a business enabler.

Orbitax and Taxvibes partnership

By partnering with Orbitax, Taxvibes underscores its commitment to supporting tax functions to streamline and automate their direct tax processes.

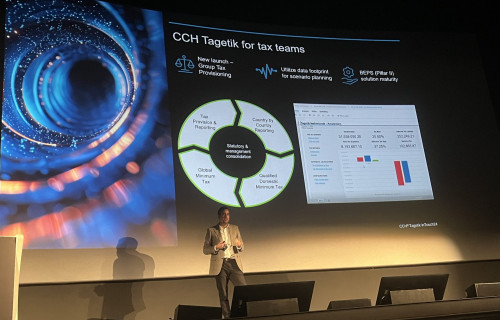

Launch of the CCH® Tagetik Tax Provision & Reporting solution

Following the successful launch and implementation of the Global Minimum Tax (Pillar Two) solution last year CCH Tagetik invested in the development of the Tax Provision & Reporting solution. Want to know more? Read on!

Webinar: How to optimize your Pillar Two framework in OneStream?

We have designed a Pillar Two solution that will help you with the full end-to-end process. In this webinar we will show you how to optimize your framework with this solution!

Taxvibes receives CCH Tagetik Pillar Two award

Thrilled to receive an award from CCH Tagetik! Such milestones cannot be met without wonderful partners, and this is exactly one of our most valued assets: good collaboration with software vendors such as Wolters Kluwer, CCH Tagetik and implementation partners like element61.

Webinar: How to optimize your OneStream platform for Pillar Two

As of 2024, companies need to be ready for Pillar Two, the new global minimum taxation rules. Pillar Two brings along unprecedented new data requirements and extensive calculations, posing new challenges for tax teams. Our Pillar Two solution for OneStream helps with the full end-to-end process. Our solution is available standalone or as part of our OneStream tax suite. In this webinar we show you some capabilities it offers.