How to use OneStream XF for your tax processes

More and more companies are starting to automate their tax processes. Not surprisingly, as tax automation makes your tax accounting faster, easier and more reliable. And the good news is that you can now use your OneStream XF platform for your end-to-end tax reporting.

Tax expert Bas van Eijk and OneStream consultant Jorrit Jan Boonstra explain how to move your tax processes from Excel to OneStream XF. Which benefits will this move give you? And what will it look like?

Tax Provisioning Template for OneStream XF

The new Tax Provisioning template for OneStream XF helps you to get even more out of your platform, as it enables you to use your Performance Management solution for your end-to-end tax reporting as well. The template is easy to implement in your current platform, making tax automation an interesting possibility.

A team of experts of sister companies Finext and Taxvibes joined forces to create the solution in OneStream, combining the knowledge of Tax and OneStream specialists. The OneStream Tax Provisioning template is based on a proven Tax template, which has been developed by Taxvibes and is used by many multinationals world-wide.

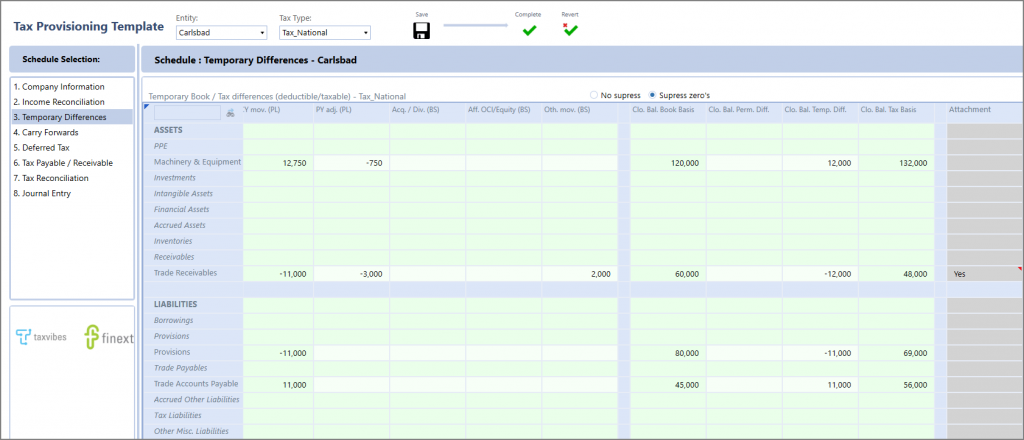

The template has a solid track-record and is specifically developed to take you through the various steps of the tax process. For instance, it gives you a clear overview of temporary differences. The template is updated whenever new legislation or trends occur; hot topics such as various future tax rates have already been included in the template.

The 5 benefits of using OneStream XF for your tax processes

In general, automating your tax processes gives you a number of benefits, regardless of the solution you choose. Tax automation makes your processes faster, less error-prone and more reliable. Also, it reduces a lot of manual, repetitive tasks, which allows you to spend time on those activities that add value. Using the Tax Provisioning template in OneStream XF has a number of additional benefits as well:

1. Easy to integrate into your OneStream XF platform

The template is easy to integrate into your current solution. This allows you to have an automated integration with other parts of the platform, in particular, with your consolidation application.

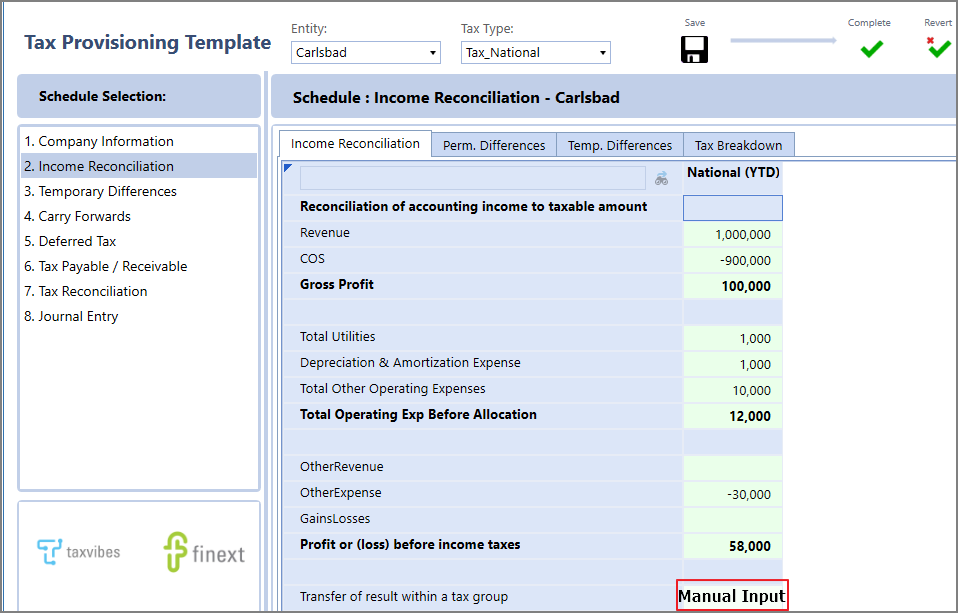

Using an automated process, your tax columns are automatically filled with the data from the consolidation module. Also, you can add data manually. As you can see in the print screen, different colors indicate whether your data was put in manually or automatically:

Integrating with your consolidation module saves you a lot of manual input and creates one version of the truth. No more differences between the financial and tax reports!

2. One way of working

As a tax accountant, you need to rely on information from the rest of the organization. By using the same platform for tax data as for financial data, users in other departments will recognize the look and feel. Seeing and using screens that people already know will make collaboration and data collection much smoother.

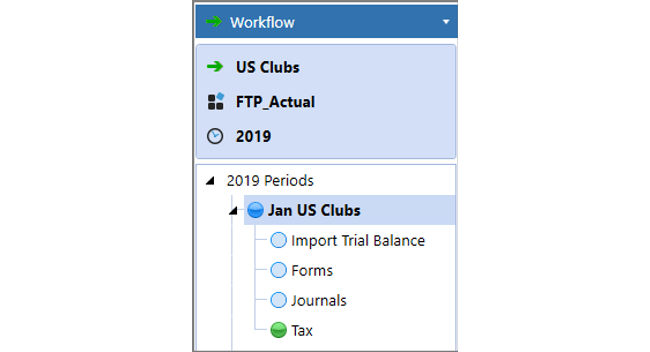

Also, you can use the same workflows. Let’s have a look at these workflows in the template. What happens if you add the tax process to the actual process?

3. Based on the balance sheet method

For tax reporting, various methods can be used. The most used method is the balance sheet method. In this method, tax reporting is based on the total balance sheet. The template uses the balance sheet method, giving you an overview of the balances of the current and the previous year, and the movements.

You’ll start with an automatically generated overview of the opening balance, which is an exact match with the closing balance of the previous year. Then, you’ll get the new closing balance of the current year, showing you the movements as well.

4. Visually appealing

The template has an Excel look & feel but is visually more appealing than Excel. Both the tool itself and the reports are user friendly and intuitive. Various elements can be seen in one overview and the workflow in the tool follows the steps you would take manually.

This workflow shows your 4 logic steps, which are easy to follow. In the first step, you’ll start with the profit before tax, the pre-tax income. This is automatically generated from the consolidation application.

The second step shows you de permanent differences and the third step the temporary differences. Finally, the fourth step shows you the taxable result.

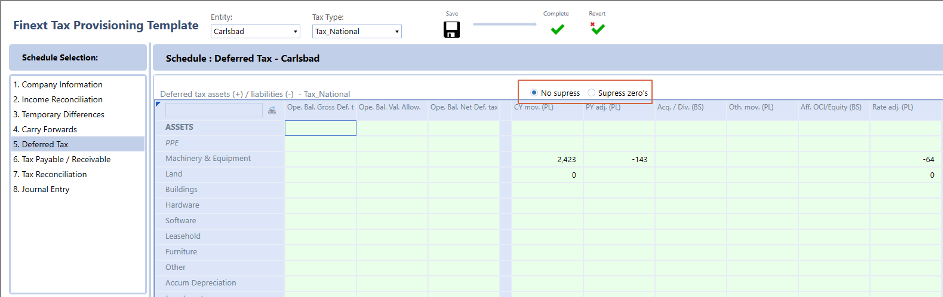

Also, reports can be shown in various ways and can be made scalable by using the suppress functionality:

5. Reporting and Dashboarding

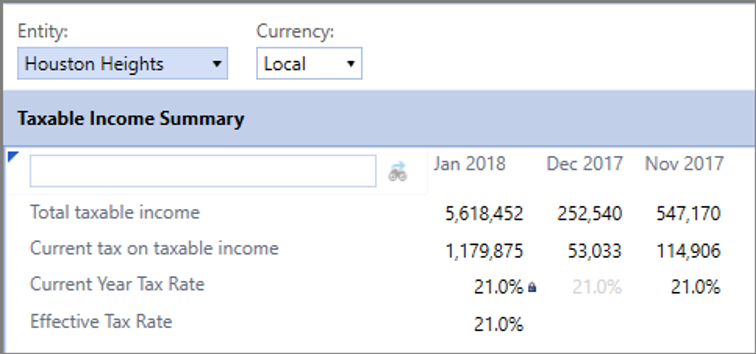

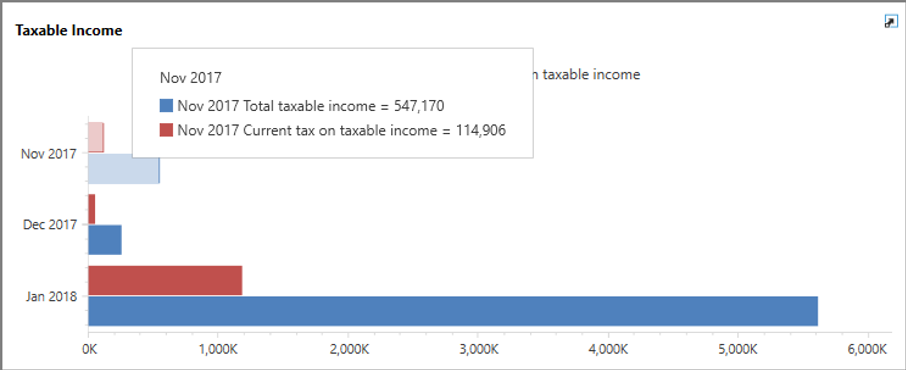

Once you’ve consolidated your tax reports, you’ll probably receive ad hoc requests. You may want to know the profits for just 1 single entity, or for a total consolidated region.

As this data is available, you can quickly create ad hoc reports and use the ad hoc analyses tool in OneStream XF, which has a direct link with the databases, including your tax databases or you can use our pre-defined Dashboards:

Simplify your tax reporting with OneStream XF

Using your current Performance Management platform for your tax reporting as well has a number of benefits. And it doesn’t involve new licenses or a new way of working for the users in your organization, making it easy and cost effective to simplify your tax processes.

View the webinar

In the webinar 'Tax Provisioning in OneStream' we show you how to simplify your Tax Provision and Reporting process with a fully integrated Tax solution within OneStream Software. Please enter your details to view the webinar directly.

Thanks!

View the webinar

-

Webinar Tax Provisioning in OneStream

Simplify your Tax Provision and Reporting process with a fully integrated Tax solution within OneStream Software. See how our Tax Solution simplifies the process and how it creates transparency.