Cases & News

Webinar: Excel-Based Integrated Tax Automation with Vena

Watch our short webinar to discover how Vena can help you streamline your direct tax processes. See how automation enhances workflows, ensures real-time data accuracy, and simplifies compliance. Covering everything from tax provisioning to Pillar Two reporting.

Centralized tax processes at Versuni with Longview

Headquartered in Amsterdam, multinational home appliance company Versuni is a leading global designer, manufacturer and seller of domestic appliances with a diversified portfolio of products. We spoke with Kanshi Ram, Tax Accounting and Reporting Lead, to hear how Versuni’s tax department has leveraged Longview Tax to transition to a centralized provisioning process.

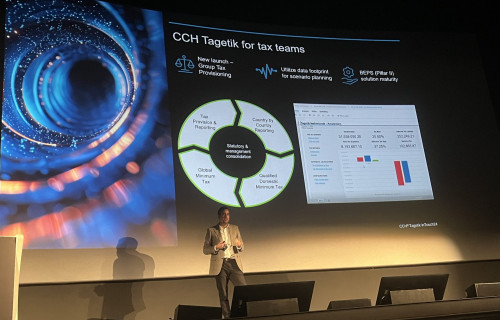

Launch of the CCH® Tagetik Tax Provision & Reporting solution

Following the successful launch and implementation of the Global Minimum Tax (Pillar Two) solution last year CCH Tagetik invested in the development of the Tax Provision & Reporting solution. Want to know more? Read on!

Demo: Tax Provisioning in SAP Analytics Cloud

This video provides a firsthand demonstration of how our Tax Reporting solution integrates with SAP Analytics Cloud

The Future of Corporate Reporting 2023

On Thursday 23 March 2023, the 10th edition of The Future of Corporate Reporting took place. With experts from leading companies, we discussed the ever-changing world of Corporate Reporting. This year’s theme: Public Accountability.

Royal Cosun automates tax processes with tax provisioning template

Royal Cosun is a cooperative of beet growers originating in the Netherlands but active worldwide. The organization reports under Dutch GAAP and communicates the preliminary yearly results before the audit. Implementing the tax provisioning template in OneStream makes the tax processes faster, more reliable, and more efficient for everyone involved.

The Future of Corporate Reporting 2022

Want to discover all the latest trends in Corporate Reporting? Rewatch the inspirational sessions we’ve hosted during our event!

Podcast: perfecting Tax Provisioning at Van Lanschot Kempen with CCH Tagetik

Together with our partner Finext we were invited to Wolters Kluwer’s first episode of their new podcast series Finance Innovation Insiders, Insider’s guide into digital transformation. Want to know how Taxvibes perfected the Tax Provisioning at Van Lanschot Kempen with CCH Tagetik? Listen to the podcast!

Taxvibes makes tax automation easier

Increasingly, organizations are looking for ways to automate their tax processes. Not surprisingly, since tax automation reduces the amount of repetitive manual activities. At the same time, it improves the quality and reliability of tax reporting. The newly launched Taxvibes helps organizations to make tax automation easier.