Cases & News

IFRS 18: Key Tax Department Impacts Explained

IFRS has released a new standard for presentation and disclosure, replacing IAS 1. This new standard has several requirements and implications for the tax department. We give a run-down of the most important changes and what they mean for you.

Bridging Pillar Two Reporting and Compliance

Multinational groups must consider both Pillar Two financial reporting and local compliance for member jurisdictions. Differences lie with respect to calculations and process implications for the tax department.

Centralized tax processes at Versuni with Longview

Headquartered in Amsterdam, multinational home appliance company Versuni is a leading global designer, manufacturer and seller of domestic appliances with a diversified portfolio of products. We spoke with Kanshi Ram, Tax Accounting and Reporting Lead, to hear how Versuni’s tax department has leveraged Longview Tax to transition to a centralized provisioning process.

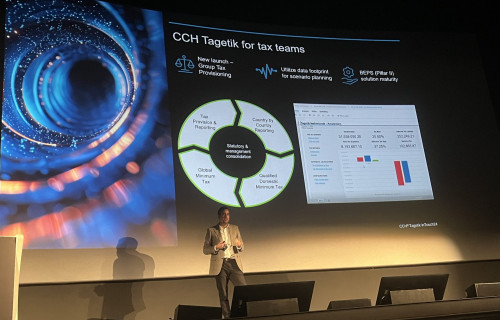

Launch of the CCH® Tagetik Tax Provision & Reporting solution

Following the successful launch and implementation of the Global Minimum Tax (Pillar Two) solution last year CCH Tagetik invested in the development of the Tax Provision & Reporting solution. Want to know more? Read on!

Webinar: How to optimize your OneStream platform for Pillar Two

As of 2024, companies need to be ready for Pillar Two, the new global minimum taxation rules. Pillar Two brings along unprecedented new data requirements and extensive calculations, posing new challenges for tax teams. Our Pillar Two solution for OneStream helps with the full end-to-end process. Our solution is available standalone or as part of our OneStream tax suite. In this webinar we show you some capabilities it offers.

Webinar Pillar Two in OneStream

As of 2024, companies need to be ready for Pillar Two, the new global minimum taxation rules. Pillar Two brings along unprecedented new data requirements and extensive calculations, posing new challenges for tax teams. Our Pillar Two solution for OneStream helps with the full end-to-end process. Our solution is available standalone or as part of our OneStream tax suite. In this webinar we show you some capabilities it offers.

The Future of Corporate Reporting 2023

On Thursday 23 March 2023, the 10th edition of The Future of Corporate Reporting took place. With experts from leading companies, we discussed the ever-changing world of Corporate Reporting. This year’s theme: Public Accountability.

Just Eat Takeaway.com improves its tax reporting process with IFRS tax template in OneStream

Just Eat Takeaway.com is a fast-growing, leading global online food delivery marketplace. Automating its tax processes saves time, improves control, and creates transparency.

The Future of Corporate Reporting 2022

Want to discover all the latest trends in Corporate Reporting? Rewatch the inspirational sessions we’ve hosted during our event!