Your practical guide to tax automation

Still juggling spreadsheets, reconciliations, and manual reviews?

Work smarter by automating step-by-step, from data collection all the way to report creation. Learn how you can:

- Re-use existing data

- Validate your data

- Strengthen control

- Reduce manual work

Are you still manually extracting data, formatting spreadsheets, and reconciling finance input? Then tax automation has something for you. Are you losing time tracking your tax team’s changes across files? Here tax automation can also add value.

Many tax teams face similar challenges that automation can tackle: the race against reporting deadlines with fragmented data, repetitive reconciliations and limited visibility. Taxvibes can help you move through different levels, and you choose the level that fits your goals and resources.

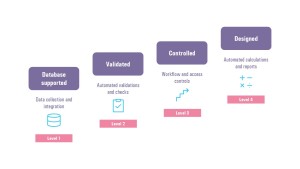

Below we explain four key levels of automation, and as an example how they could work together in your tax provisioning process.

1. Database supported

If you find yourself reconciling the same finance data over and over, automated data collection and integration is a good starting point. Sourcing trial balance data from a central database means you:

- Work with one source of truth, provided in real-time.

- Ensure your tax calculations seamlessly flow back to finance.

Example in your tax provision process:

Instead of manually downloading Excel files from each subsidiary, the system automatically extracts all (local) trial balances. All data is mapped to your global chart of accounts, eliminating copy-paste errors and manual uploads. The tax team can immediately start reviewing pre-filled templates rather than collecting data.

2. Validated

Are you discovering errors in your finance data during the financial close? Get ahead of these issues by building in automated validations and checks. Once your data is integrated, you can then effectively:

- Apply automated checks to ensure data integrity, such as validating that a subsidiary’s pre-tax profit ties to the group’s consolidated result.

- Prevent time-consuming re-calculations, for example on equity pick-up adjustments for this subsidiaries’ holding company.

Example in your tax provision process:

The system flags any mismatch between book profit and tax adjustments. For instance, if a subsidiary’s deferred tax movement doesn’t reconcile with its temporary differences, the model highlights the inconsistency automatically, allowing you to fix it early in the process.

3. Controlled

Are you working across multiple files sent through email to control access? Then workflow and access control automation is for you.

- Keep track of who has done what, what is still pending, and when it needs to be completed.

- Control access across multiple criteria. You set what local teams, external advisors, and auditors can edit and view based on their needs. This means your local tax accountant responsible for the subsidiary cannot make changes to the holding company.

Example in your tax provision process:

Each entity receives an automated task notification when their data load is due. Once submitted, it’s locked and routed for review to the tax team. Both you and your controlling colleagues can see progress across all entities in one dashboard, no more chasing updates in Excel versions.

4. Designed

Are you reinventing the wheel every close cycle? Then designing automated calculations and reports will save you time. This is the most advanced level of automation, providing the most consistency across your periods and jurisdictions.

- Never input the same number twice, so calculation logic flows smoothly between processes.

- Produce standard reports and outputs, from tax provision to Pillar Two top-up tax calculations.

Example in your tax provision process:

With pre-built calculation logic, prior-year adjustments automatically flow into next year’s opening balances. Your tax provision, effective tax rate reconciliation, and Pillar Two reports are generated with only some clicks of a button and can fully be traced back to source data.

The impact? At any layer of automation experience fewer errors, smoother processes, more control, and more time to focus on the interesting part of the job: interpreting results, advising the business, and spotting opportunities.

Not sure where to start? That is where we come in. We help organizations map out their tax processes and other internal requirements to identify where automation adds value. This way, you select the right tools and partners to get there.

More cases & news

Taxvibes makes tax automation easier

Increasingly, organizations are looking for ways to automate their tax processes. Not surprisingly, since tax automation reduces the amount of repetitive manual activities. At the same time, it improves the quality and reliability of tax reporting. The newly launched Taxvibes helps organizations to make tax automation easier.

Three key areas essential for a successful tax automation strategy

In this article, we explore three key areas—processes, data, and knowledge—that are essential for a successful tax automation strategy. Learn how to take small, manageable steps towards automation and transform your tax function into a business enabler.