IFRS 18: Key Tax Department Impacts Explained

Unsure how to prepare for IFRS 18?

The tax and finance department must prepare now to issue comparative restatements for IFRS 18, effective 2027. Be ready to split your tax expense into operating, investing and financing and track tax charges on normalizations.

IFRS has released a new standard for presentation and disclosure, replacing IAS 1. This new standard has several requirements and implications for the tax department. The key changes (effective January 2027) include:

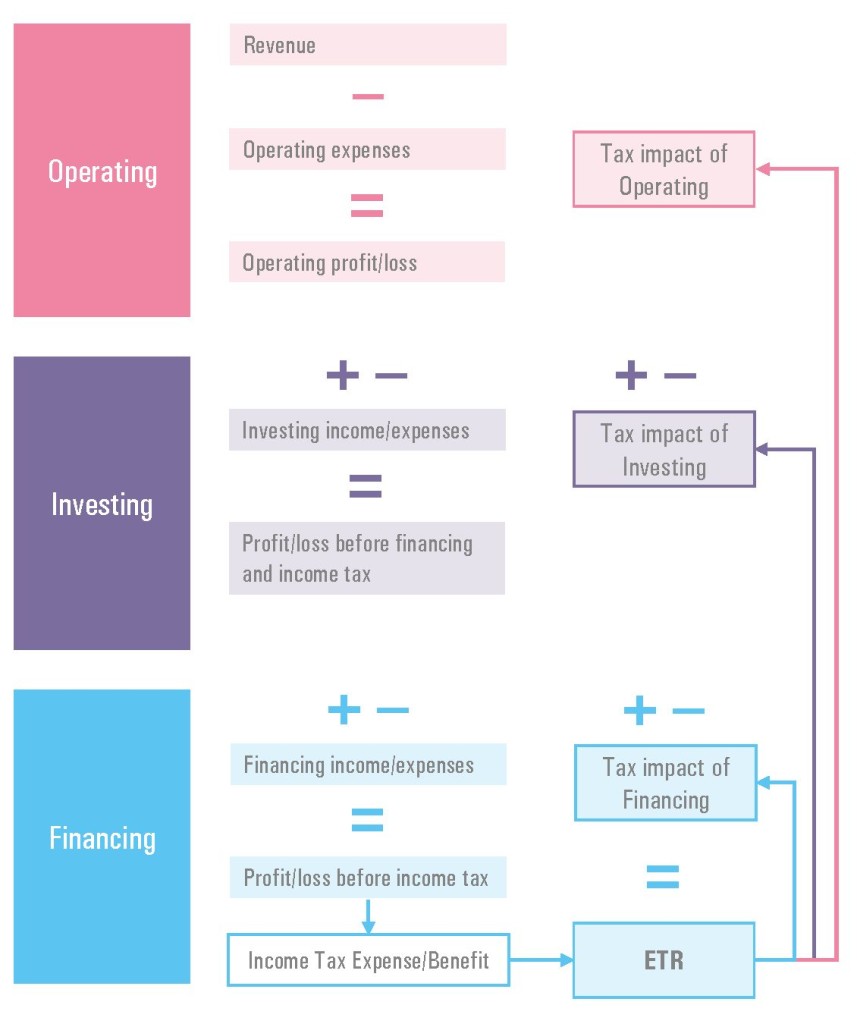

- Mandatory profit and loss presentation structure into the following classification categories [IFRS 18:47]:

- Operating

- Investing

- Financing

- Income taxes

- Discontinued operations

- These categories then require a split of subtotals for profit and loss into Operating profit and Profit before financing and income taxes [IFRS 18:71].

- Disclosure of Management Defined Performance Measures (“MPM”). These non-IFRS income and expense items used in public communications must now be disclosed in a note reconciling the difference to the most comparable IFRS measure [IFRS 18:123(c)].

- More scrutiny on (dis)aggregation of income and expenses items by nature or function, and use of line ‘Other’ [IFRS 18:41].

Process and Calculation Impacts

What does this new standard mean for your tax process?

Profit and loss categories and subtotals

Overall, the increased shift from principles-based guidance to a defined structure requires finance and tax departments to be prepared with full audit trails and supporting documentation.

For external reporting purposes, the income tax line in the financial statement remains the same. However, closer alignment with your finance colleagues is needed as every presentation change can have a tax reporting impact. In general:

- Operating profit is to be treated as the default subtotal, and profit before financing and income taxes is specified.

- Although not an external requirement, expect new interactions with stakeholders on three separate effective tax rate reconciliations and tax expense overviews. These being for Operating profit and loss, Investing profit and loss and Financing profit and loss.

- Anticipate questions related to how much income tax relates to Operating result and how much to the other buckets.

Management Defined Performance Measure Disclosure (“MPM”)

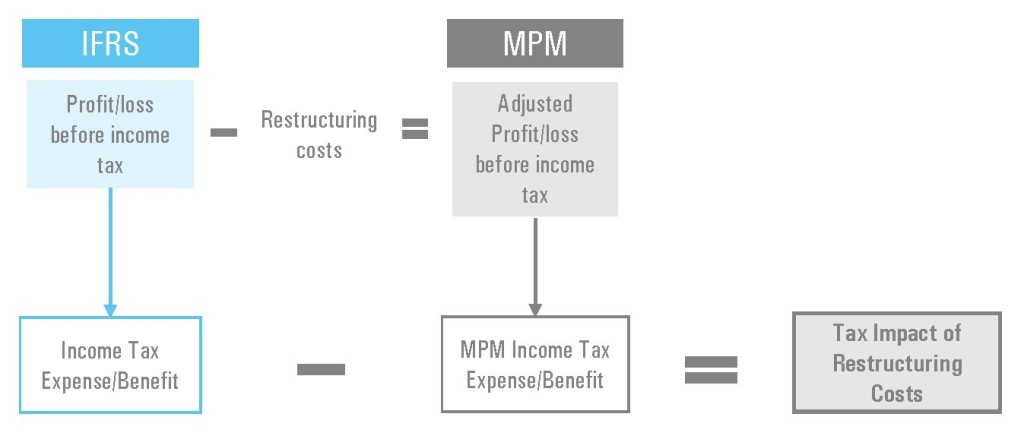

The tax department is involved in the detailed calculations behind management-defined performance measure reconciliation disclosure.

- The income tax effect of each management measure must be calculated and reported alongside a description of the method. For instance, the tax effect of restructuring costs excluded from Adjusted profit, compared to non-Adjusted Profit, as shown below.

- In many cases the most comparable IFRS measure will be a new IFRS 18 profit and loss subtotal, adding further complexity to this disclosure requirement.

- Two methods are provided for these calculations. First, the tax effect can be calculated for each transaction underlying the MPM adjustment. Ensuring a solid connection between your transactional level finance and tax data is essential if this method is adopted.

- Second, the tax expense can be allocated pro rata to the adjustment item. This is more complex and requires that adjustment tax effects are calculated at the end of the process. Smart workflow tools make these calculations consistent.

The new level of consistency in presentation required by IFRS 18 gives a different view on the tax reporting data. Questions from stakeholders on new profit and loss categories can influence decision making. Finance-driven performance measures now involve calculations on the tax side.

And as always with IFRS presentations, you will need updates to restate your comparable numbers. So although effective January 2027, you need to be ready with your 2026 accounting!

Are you ready for these changes? Reach out below for more information on how to prepare your process, data, and people.

Want to get ahead of the IFRS 18 changes?

Get in touch below.

Thank you!

More cases & news

Your practical guide to tax automation

Still juggling spreadsheets, reconciliations, and manual reviews? Work smarter by automating step-by-step, from data collection all the way to report creation.

Webinar: Uncertain Tax Positions (IFRIC23) & Longview Tax

Tax provisioning is a highly complex area that is in both the tax and the accounting domain. Within many Finance departments tax is often conceived as slowing down the close cycle as a whole. The new rules on uncertain tax provisions (IFRIC 23) can add to the complexity. In our webinar we have shown how these changes might affect your tax position.